Payment solutions are a critical touchpoint that shapes customer satisfaction, loyalty, and trust. From seamless checkout processes to flexible payment options, businesses that prioritize innovative payment solutions can create smoother, more enjoyable experiences for their customers. Check the latest trends in payment technology, and invest in the right system that can set your business apart.

The easy access to digitalization has given your consumers more power to decide whether they want to buy your product or not. Even if you own a great product or service, the way you accept payments can have a big impact on your customers’ experience and loyalty.

Payment options have come a long way since the days of only accepting cash or cheques or being limited to trading in a single currency. Now, it’s important that your customers can pay in their own currency, or that they have an option of currencies to choose from. Customers also expect to have easy access to mobile payments and to being able to pick a payment type that suits them.

So, if you’re running an international business and are unsure about the impact that the payment methods you offer will have on your customers and on gaining more customers – we think this article will help you see that the impact is significant and can make the real difference to your business’s success.

The Importance of Payment Solutions for Customer Satisfaction

When it comes to running a successful business, satisfied customers are really the indicator of how well you’re doing – we hope you think the same!

So, to keep your customers satisfied, one key factor that can make or break your business is what they experience when they make a purchase with you. Have you ever gone to a restaurant or store where the payment procedure was sluggish, unclear or simply out of date? In the same way, if your business has an option for online payments, for example, and you are not able to keep up with the requirements, it can put off your customers very easily!

So, let’s circle back to the important question we’re considering – what kind of payment solutions make your customers happy? Starting off, their experience can be impacted by how easy your payment gateway is. Your customers will likely be frustrated if they have to wait for long or have to put in gazillion details before making the payment. However, if you have easy payment choices such as contactless cards, mobile payments, currency conversions etc, then it can simplify most of your and your customers’ processes.

Security is just another way to make payment systems trustworthy. In this fast-paced digital world we now all live in, some customers can understandably become anxious about making payments on new sites. On the other hand, by providing secure payment solutions like fraud protection and encryption, you’ll be going some distance to helping your clients feel safer and giving them peace of mind which will encourage them to come back to your business again. Selecting the best payment processor will help you to protect both your money and that of your customers.

How Payment Solutions Affect Customer Loyalty and Retention

Now let’s understand how customers stay with you if you make their life easier! If your payment options are tailored according to their preferences, you can create a positive customer experience, it shows that you value their business. Loyal clients can be encouraged to keep doing business with you by receiving rewards through loyalty programmes connected to your payment solutions. Additionally, providing clients with a simple and modern payment process can increase the likelihood that they refer you to others too. Basically, by prioritizing these small things in your business, you are preparing your business for the long term.

Improving Customer Experience through Payment Innovation

Innovation in payment solutions brings immense improvement in customer retention. If you keep up with the most recent payment industry trends, then here’s the good news – you may give your clients faster and more secure solutions. Simply put, this is an excellent way to keep up with the competition.

With contactless payment systems such as Apple Pay or Google Wallet, customers can make fast and easy payments on your website or during in-person purchase – without having to physically touch a payment terminal or exchange currency. Much like online payments, mobile payments enable customers to make purchases straight from their mobile devices. You can integrate these services in your business payment systems.

This can also enable businesses to offer personalized offers, rewards, and loyalty programs tied to their mobile payment solutions, creating a more engaging and personalized experience for customers.

Another innovative payment solution that can improve the customer experience is in-app payments. By allowing customers to make purchases directly within a mobile app, businesses can offer a seamless and convenient shopping experience that can lead to increased customer loyalty.

Understanding the Role of Payment Solutions in E-commerce

Let’s talk about payment solutions – the hidden hero of online shopping! Every successful e-commerce company is built on the shoulders of this hero – someone that makes sure that your customers can deal with you quickly and securely.

Think about it- When was the last time you completed an online purchase without using a payment method? We know it’s hard to imagine! That’s because payment solutions subtly ensure that everything is planned out while you shop on the website.

However, here’s the thing that only businesses start caring about when they start their online business – payment solutions go beyond just handling money. They are essentially responsible for enhancing customer experience!

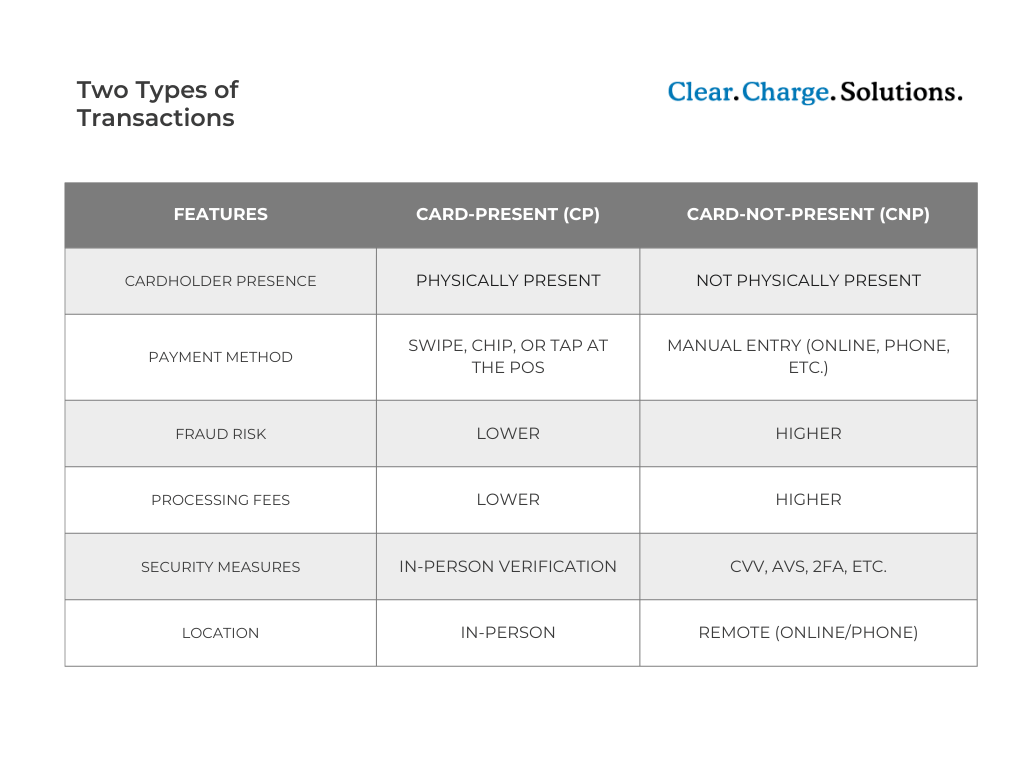

A payment gateway is a piece of software that safely encrypts credit and debit card payment information. It moves data between the customer’s bank and the merchant bank from the merchant’s website. The payment gateway on the merchant’s website handles transactions – where it can accept or decline payments.

By offering a variety of payment options, such as credit cards, PayPal, and Apple Pay on your payment gateway, you can ensure that your customers can pay in their most preferred way – something that is also convenient and easy for them. And let’s be real, who doesn’t love a little convenience in their lives?

Benefits of Offering Multiple Payment Options to Customers

So far, you know how effective payment solutions can help you in retaining your customers. But, there are additional benefits that can elevate your business’s performance by adopting smart technology in your business:

- Increased customer retention: When you cater to different expectations of your customers, you are making it easier for them to shop with you. This can reduce cart abandonment and increase conversion rates!

- Expanded customer reach: By allowing a variety of payment options, businesses can draw in customers who might not otherwise be able to make a purchase. Businesses can enter a new market by allowing options such as digital wallets or cryptocurrencies.

- Increased conversion: Giving your customers a range of payment options will lessen the chance of getting dodged by them during the payments. As a result, the company can see improved conversion rates and higher sales.

- Competitive advantage: Numerous companies have already been offering a wide range of payment alternatives. You run the risk of slipping behind your competitors and losing customers if you don’t give your customers enough options and easy ways to shop.

- Cash flows: You may be able to manage your cash flow better by giving your clients options like instalment payments and regular billing.

- Reduced risk of fraud: By offering secure payment options, such as tokenization and 3D Secure, you can reduce the risk of fraud and improve the security of your transactions.

- Automatic currency conversion: International businesses sell their products and services overseas and often sell them in the customer’s local currency. At the same time, you would want to receive proceeds from sales in your own currency. With effective payment options, you can sell your products in other currencies and receive money in your own local currency directly.

The bottom line is that providing a straightforward but efficient strategy can enhance your customer experience, boost your client’s loyalty and ultimately promote long-term business success. So, don’t be afraid to mix it up and offer a range of options to your customers!

How Payment Security Impacts Customer Trust and Confidence

- Fraud prevention: Payment security tools like tokenization and 3D Secure can help in protecting the private information of your clients. This can further reduce the likelihood of fraud among your hard-earned customers. This benefits both parties because your customers will come to feel that your business is trustworthy and safe to invest their money in!

- Compliance with regulations: Customers will see that your company takes security seriously and is committed to protecting their information. Usually, if you comply with all the security requirements like Payment Card Industry Data Security Standard (PCI DSS), you are less likely to face fines or legal action for data breaches.

- Communication transparency: Being transparent with your customers about your payment security measures and how you handle their personal data can help foster trust and confidence in your company. By openly communicating your security protocols and practices, you can help your customers feel informed and secure in their transactions.

- Reputation management: A security lapse or a data leak can seriously harm the long-earned reputation of your company. You can protect your brand and gain your consumer’s trust by prioritizing payment security and taking proactive steps to protect their personal information.

How to Maximize Customer Convenience with Mobile Payment Solutions

- Offer various options: Make sure to offer a variety of mobile payment options, such as Apple Pay, Google Pay and Samsung Pay. This allows your customers to shop freely with the choice of the most convenient option.

- Promote M-payments: You can promote your mobile payment options amongst your customers. Spread the word that you accept mobile payments through your website, social media channels and in-store signages. They can be a great way to draw attention and get your online solutions up and running in no time.

- Train your staff: A well-trained personnel is the backbone of your business. So, make sure that you train them enough to educate customers about your payment solutions and can assist those who are new to using them. They can help create a positive and seamless experience for your customers.

- Make the process seamless: Ensure that the mobile payment process is quick and easy for your customers. Every checkout station can have mobile payment terminals, and the transaction process should be simple and user-friendly.

- Put security first: Regardless of the size of your business, make sure that you choose transaction security as your utmost priority. Consider implementing biometric authentication or tokenization to enhance security and reduce the risk of fraud.

The Role of Personalization in Payment Solutions and Customer Experience

Imagine offering customized payment options, like the ability to save a customer’s preferred payment method and personalizing financing options for them. And what about establishing a more personal and intimate connection with your customers by using personalized communication based on their payment patterns, there’s lots of possibility for connecting more authentically with your customers’ needs when you start to look!

Individualized rewards can sweeten your deal with your customers and create a more personalized shopping experience. Based on their spending patterns, your company can use data and analytics to offer personalized recommendations – and let’s admit it, who does not love a tailored suggestion that directly speaks to their interests and behaviors?

Understanding the Most Popular Payment Methods for E-commerce

When it comes to e-commerce, there are certain popular methods that customers find favorable. Undoubtedly, the most popular among these are credit or debit cards, closely followed by digital wallets like PayPal, Apple Pay and Google Pay. Popular solutions also include bank transfers and direct debits, especially in countries where cash transactions are less common. Additionally, many e-commerce companies also include “buy now, pay later” alternatives – allowing shoppers to order things and pay for them over time in instalments. Commerce companies need to provide multiple payment options to cater to different customer preferences and increase the possibility of successful transactions.

The Pros and Cons of Accepting Credit Cards for Online Payments

Let’s break down the pros and cons of accepting credit cards for online payments

Pros

- Since credit cards are so extensively accepted, clients can use them as a convenient form of payment.

- Accepting credit cards can improve the likelihood that transactions will be completed and boost sales.

- Credit card payments can secure both the company and the client by leveraging cutting-edge fraud prevention techniques.

Cons:

- Processing fees for credit cards might reduce your profit margins, especially for smaller transactions

- Managing chargebacks and disputes can become a headache and can cost you unnecessary expenditures.

- Because credit card information is vulnerable to theft and hacking, companies must invest heavily in security measures.

Going Global: Payment Method Considerations for International E-commerce

- Countries have their own preferred payment methods. Research the most popular payment methods in the countries that you will be selling in. This way, you will enhance your customer experience by offering them the most relevant way to pay for your product or service.

- Currency exchange rates: The currency exchange rates can impact the pricing and profits. To make the process simpler, think about utilizing a payment gateway that can manage several currencies and exchange rates.

- Each country has its own rules and limitations regarding payments. Make sure that you are aware of relevant rules that can affect your ability to accept payments from different countries.

- Language barriers: One of the underrated problems of payment gateways is language barriers. Make sure your payment gateway and checkout process are available in the local languages of the countries you’d be selling to.

By taking these aspects into account, you can optimize your e-commerce business for international success swiftly and effectively.

Cryptocurrency and E-commerce: Should You Accept Digital Currency Payments?

With cryptocurrency as a serious option, there are a few things to consider before deciding to accept it as a digital payment option. It’s important to understand the pros and cons of it:

Pros:

- Since crypto is decentralized, it comes with zero pesky transaction fees or third-party intermediaries taking up a chunk of your profits.

- You may also be able to attract more tech-savvy and cryptocurrency-curious customers by accepting payments in digital currencies.

- Customers feel more comfortable with digital currencies since these currencies are secure and virtually immune to fraud and hacking. This can enhance peace of mind and increase faith in your business.

Cons:

- Crypto is relatively new in the market and unfamiliar to many customers, it can create a barrier to adoption and limit the number of completed transactions

- Digital currencies tend to fluctuate, making pricing and accounting slightly more difficult.

- Accepting payments in digital currency may be subject to legal and regulatory restrictions, depending on your sector and area.

In general, taking payments in digital currency can be a good idea for businesses looking to stay ahead of the curve and attract tech-savvy customers. But, it’s equally important to weigh potential downsides and make sure that you have the necessary infrastructure and regulatory framework in place to handle this payment method.

Balancing Security and Convenience: Choosing the Right Payment Methods for Your Business

When you choose payment methods for your website or business, finding the best balance between ease and security is key.

Security-focused payment methods:

- Credit and debit cards: These payment methods come with built-in fraud protection and chargeback rights for customers

- PayPal: As a well-known online payment provider, PayPal provides cutting-edge security features like 2-factor authentication and fraud detection algorithms

Convenience-focused payment methods

- Mobile payments: Customers may easily make mobile purchases while on the move. Thanks to mobile payment solutions like Apple Pay and Google Wallet it’s absolutely easy to do so.

- Digital wallets: Programs like PayPal and TransferWise enable users to receive payments with only a few taps on their mobile devices, store payment information and transfer and store money.

Future Trends in Payment Solutions and their Impact on Customer Loyalty

As the payment solutions industry continues to evolve, businesses must keep up with the latest trends to maintain customer loyalty. Contactless payments, biometric authentication, cryptocurrency, and integrated payment solutions are just a few of the trends that are shaping the industry. By offering fast and convenient payment options, businesses can enhance the customer experience and improve loyalty. Providing added security and convenience with biometric authentication methods can further help businesses build trust and loyalty with their customers. The use of cryptocurrencies as payment methods is expanding, attracting clients who are tech-savvy and forward-thinking. Integrated payment solutions connect in-store and online purchases. This helps in making the purchasing process simpler and lets your customers maintain their accounts more effectively.

Ready to elevate your customer experience with advanced payment solutions? Contact us today at (877) 847-4478 to discover how our credit card processing services can transform your business. Let’s make every transaction seamless! Check our IG for more information.

Reference: [https://blog.wamo.io/the-impact-of-payment-solutions-on-customer-experience-and-loyalty/]